Consignment

1. Important Terms Used In

Accounting For Consignment Of Goods

·

Consignment

The

dispatch or transfer of goods to an agent for the purpose of sale on behalf and

risk of principal is known as consignment

·

Consignor

The owner

or principal who sends the goods to agent is known as consignor.

·

Consignee

The agent

to whom the goods are sent is known as consignee.

·

Consignment Outward And

Consignment Inward

The goods

sent by consignor to the consignee is consignment outward. The same goods will

be consignment inward for the consignee.

·

Pro-forma Invoice

It is an

invoice prepared by the consignor and sent to the consignee detailing the

weight or quantity and the price at which the goods are to be sold. It is an

evidence of consigned goods indicating the price at or above the consignee will

have to sell the goods. Though it seems as a sales invoice in format, it is

quite different from it. A sales invoice is a document sent by a seller to

buyer which charges the buyer with the value of goods.

·

Account Sales

The

consignee has to inform its consignor about sale and expenses incurred by him

for selling activity. For this purpose, the consignee has to prepare a

statement which is known as account sale. An account sale is a statement of

sales and other expenses incurred by the consignee while performing sale. It

can be taken as a base of consignor's books of account for recording sales and

expenses incurred by the consignee for selling the consigned goods.

The various expenses are required

for goods sent by consignor to consignee. Similarly, the expenses are also

required for storing and selling activity performed by the consignee. These

expenses are of two types:

1.

Non-recurring Expenses:

The expenses incurred between the period of goods sent by consignor to receive

by the consignee is known as non-recurring expenses. In other words, all

expenses incurred till the goods reach to the consignee are non-recurring

expenses. Examples of non-recurring expenses are as follows:

Expenses

of the consignor

·

Packing

·

Carriage

·

Docks

dues

·

Landing

Charge

·

Freight

·

Insurance

Expenses

of the consignee

·

Unloading

charge

·

Dock

dues

·

Import

duty

Non-recurring expenses must be

included in the cost of the consignment. For arriving at the consignment, these

expenses are added. These expenses are also taken into consideration while

calculating the value of unsold stock or closing stock with the consignee.

2.

Recurring Expenses

The expenses paid by the

consignee after receiving the consigned goods are known as recurring expenses.

These expenses are of recurring nature and do not increase the value of goods.

Though the recurring expenses are met by consignor or consignee, these expenses

should be borne by the consignor. Some examples of recurring expenses are as

follows:

Expenses

of the consignor

·

Bank

charges

·

Expenses

incurred on damaged

·

Goods

received back

Expenses

of the consignee

·

Storage

charge

·

Insurance

·

Brokerage

·

Advertising

·

Salary

to salesmen

·

Expenses

on goods return

·

Goods

damaged

·

Commission

on sales

1.

What

is consignment?

Consignment meaning:

-

A batch of goods meant for or delivered to someone.

-

The action of consigning or

delivering something.

Shipment

of goods by a manufacturer or wholesale dealer to an agent to be sold by him on

commission basis, on the risk and account of the consignor (person who sends

the goods) is known as consignment.

2. Mention

the parties in consignment.

a.

Consignor : owner of the goods

b.

Consignee: person who receives goods

from consignor or owner. He sells goods on behalf and risk of consignor and he

gets some commission for doing this job

3. What are

the features of consignment?

Features of consignment are:

a.

The relation between the two parties

is that of consignor and consignee and not that of buyer and seller

b.

The consignor is entitled to receive

all the expenses in connection with consignment.

c.

The consignee is not responsible for

damage of goods during transport or any other procedure.

d.

Goods are sold at the risk of

consignor. The profit or loss belongs to consignor only.

4. State the

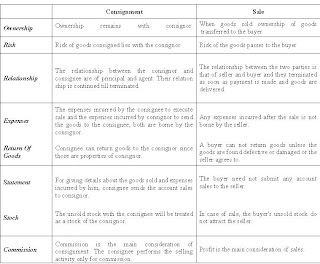

difference between consignment and sale.

Consignment

can not be treated as sales of goods. It is different from sales. The

difference between consignment and sales are as follows:

6. Write a

note on following terms

a.

Commission or ordinary commission

b.

Del credere commission.

c.

Over- riding commission or special

commission

-

Commission or ordinary commission.

For serving as an agent of the consignor, the

consignor, the consignee is entitled to some remuneration. The remuneration

payable to the consignee for his service is called “commission “or “ordinary

commission”

The

commission is, generally, fixed at a certain percentage on the gross sale

proceeds (I.e. on the total of cash and

credit sales).

The commission charged by the

consignee on the gross sale proceeds is known as ordinary or simple commission.

It is calculated at fixed percentage of total sales.

Commission = Gross sales X Fixed

rate percent of commission

-

Del credere commission: consignee sells goods either for

cash or on credit or on both. When the consignee sells the goods on credit,

ordinarily, he does not guarantee that the debtors will make the payment.

Therefore, if some of the debtors fail to pay their dues, the consignee is not

responsible for the bad debts. The bad debts have to be borne by the consignor.

However,

when consignee undertake to bear the risk

of bad debts, some extra commission

is payable by the consignor to consignee for the consignees special services.

The extra commission payable by the consignor to the

consignee for the consignee special services (i.e., his undertaking the risk of

bad debts arising out of credit sales ) is called del credere commission.

·

Once

extra commission paid to consignee, he is responsible for all the bad debts.

·

He

is not responsible for loss due to disputes regarding the quality of goods.

·

Commission

is calculated based on total sales or credit sales.

·

Absence

of any agreement commission calculated based on total sales. (i.e., total of

cash and credit sales).

-

Over- riding commission or

special commission

·

The

additional commission paid over and above the ordinary commission is called

over – riding commission or special commission.

·

The

objective of this commission is to give an incentive to the consignee to sell

the goods at a price higher than the invoice price and also to promote the sale

of new product in the market.

7.

What

is proforma invoice ?

When

a consignor consigns goods to a consignee, the consignee does not

buy those goods. He merely receives the possession of those goods for sale on

behalf of the consignor. So, the consignor does not prepare and send to the

consignee a regular invoice or invoice, which is sent when goods are sold.

But consignor prepares and sends to the consignee a statement which is

similar to the invoice. Such a statement is called proforma invoice.

·

Its serve as an evidence of consignment and to communicate

to the consignee the details of the goods sent.

·

It contains the description, quality, quantity

and price of the goods consigned.

·

It also gives consignee an idea about the price

at which the goods are to be sold.

·

The consignee is not expected to sell the goods

below th price stated in the proforma invoice without referring to the

consignor.

8.

What

do you mean by account sale ?

Either on completion of the sales or at

periodical intervals, the consignee sends to the consignor a detils of the goods sold by him in the form of a

statement. Such statement is called an account

sales.

It gives the details of :

- Gross sales effected by the consignee.

- Expenses incurred by the consignee.

- Commission due to the consignee.

- Advance paid by the consignee to the consignor.

- The final balace due from the consignee to the consignor.

- Remittance, if any sent by the consignee along with the account sale.

It

is on the basis of this statement that the consignor makes entries in his books

in respect of consignment transactions.

9.

Briefly

explain the difference between proforma

invoice and accounts sale.

10.

Explain

briefly ‘ Normal loss’ and ‘Abnormal losses’.

Sometimes , a

poriton of the goods sent on consignment may be lost or damaged either in

transit or after they reach the consignee. Such losses are of two types, viz…

1. Normal losses. 2. Abnormal losses.

Normal losses :

Normal

losses are those losses which arise from normally expected ro natural causes,

such as evaporation, leakeage,

shrinkage, breakage, loading and unloading, deying, breaking the bulk etc.

They

are inherrent in the goods consigned and so, are unavoidable, and form part of

the cost of consignment business.

·

There

is no separate entry in the consignment account for normal losses

·

They

are adjusted in the cost or value of the unsold stock.